AI-Powered Tools transform Personal Finance Management

Personal finance management can sometimes feel like juggling flaming torches while riding a unicycle. But what if I told you that advanced AI for budgeting and savings could take the stress out of managing your money too? Imagine having a personal finance management guru available 24/7, who never sleeps, never judges, and always has your back. That’s AI for you. In this post, we’ll dive into how AI can revolutionise your approach to personal finance, turning those pesky money troubles into a manageable (dare I say, enjoyable?) task.

What is Personal Finance Management?

First, let’s explain what personal finance management means in case somebody doesn’t know. Personal finance management is all about planning and controlling your financial activities, such as how you earn, spend, save, invest, and protect your money. It’s like being the CEO of your own financial empire! This involves budgeting, banking, insurance, investments, retirement planning, and tax planning. The goal? To manage your money wisely so you can achieve financial stability and reach your dreams, whether that’s buying a house, traveling the world, or simply living comfortably.

“When women are financially empowered, they hold the power to make choices and create a better future.”

Melinda Gates

Did You Know? Fascinating Facts About Personal Finance Management in Europe

- Emergency Savings Shortfall: Did you know that a significant portion of Europeans are not financially prepared for emergencies? According to the European Central Bank (ECB), many Europeans would struggle to come up with €1,000 in an emergency. This highlights the importance of having an emergency fund to cover unexpected expenses and improve financial resilience (More info here).

- The 50/30/20 Budgeting Rule: A simple yet highly effective budgeting method is gaining popularity across Europe. The 50/30/20 rule suggests allocating 50% of your income to essential expenses, 30% to discretionary spending, and 20% to savings and debt repayment. This balanced approach helps individuals prioritise their needs while still enjoying some leisure activities and building a financial safety net (More info here).

- Low Financial Literacy Rates: Shockingly, financial literacy remains low across Europe. Recent data indicates that only a quarter of Europeans demonstrate basic financial literacy, which affects their ability to make informed financial decisions. Enhancing financial education through targeted initiatives is crucial for empowering individuals to manage their finances better and secure their financial future (More info here).

These insights into personal finance management in Europe emphasise the need for better financial planning and education. By understanding these key facts, you can take proactive steps to improve your financial health and prepare for a more secure future.

What You’ll Discover

In this article, we’ll explore how AI can assist you with:

- Budgeting and Expense Tracking

- Savings and Investing

- Credit Score Monitoring

- Fraud Detection

- Personalised Financial Advice

- Family Finances

Now, grab a cup of coffee (or a glass of wine, no judgment here), and let’s see how AI can help you take control of your finances.

Budgeting and Expense Tracking: Your Personal Money Whisperer

First and foremost, let’s talk about budgeting. AI-powered apps like Mint and YNAB (You Need A Budget) are lifesavers. They categorise your expenses automatically and provide insights into your spending habits. It’s like having a financial advisor who knows your favourite pizza joint and reminds you to pay your bills on time.

A study by Deloitte revealed that 60% of users who utilised AI-driven financial tools saw an improvement in their financial health within six months. This is due to AI’s ability to analyse spending patterns and offer tailored advice.

How It Works

These apps connect to your bank accounts and credit cards, tracking every penny you spend. They categorise transactions, highlight trends, and even alert you when you’re overspending in certain categories. It’s budgeting on autopilot.

Recommendation

I highly recommend starting with Mint for its user-friendly interface and comprehensive features. It’s free and offers everything from budget creation to bill reminders. For more serious budgeters, YNAB offers a hands-on approach to budgeting that encourages proactive financial planning.

Saving and Investing: The Smart Way to Grow Your Wealth

Let’s move on to saving and investing. AI isn’t just about managing what you have; it’s also about growing your wealth. Apps like Nutmeg (J.P Morgan Company) and Wealthify make investing simple and accessible.

According to NerdWallet, users of micro-investing platforms like Nutmeg saw an average return of 5% annually, which is impressive considering the low barrier to entry.

How It Works

- Nutmeg: This app provides personalised investment portfolios based on your risk tolerance and goals.

- Wealthify: Uses AI to create a personalised investment strategy and automates the entire process, from rebalancing to tax optimisation.

Recommendation

For those new to investing, Nutmeg is a fantastic way to start. It’s effortless and educational. If you’re looking for a more hands-on approach, Wealthify provides comprehensive investment management that’s perfect for long-term goals, specially regarding savings and investment.

I will be covering the topic of investment in another post, but for now, I highly recommend visiting Female Invest. Female Invest is a revolutionary company dedicated to closing the gender gap in finance and investment by offering courses through their membership program, designed to educate and empower women to confidently enter the investment world. They provide a range of educational resources, including the highly recommended book “Women Just Want to Have Funds,” which offers valuable insights and practical advice on taking charge of your financial future. For more information, visit their official website.

Credit Score Monitoring: Keeping an Eye on Your Financial Health

Your credit score is like your financial report card. AI-powered tools like Credit Karma ( intuit) and Experian Boost can help you keep track of it effortlessly.

According to FICO, users who regularly monitor their credit scores with AI tools see an average increase of 20 points within six months due to timely alerts and personalised tips.

How It Works

These tools analyse your credit report and provide actionable insights to improve your score. They offer alerts for any changes, suggest ways to improve, and even help identify errors.

Recommendation

Using Credit Karma is a no-brainer. It’s free and provides a detailed breakdown of your credit score, along with tips to improve it. Experian Boost can give your score a quick lift by adding your utility and telecom payments to your credit report.

Fraud Detection: Your Digital Bodyguard

Fraud is an ever-present threat, but AI is here to protect you. Tools like Dark Web Scan by Experian and Norton LifeLock offer real-time monitoring and alerts.

Javelin Strategy & Research reports that identity theft victims who used AI-powered monitoring services reduced their recovery time by 50%.

How It Works

These services continuously monitor your accounts and alert you to any suspicious activity. They scan the dark web for your information and notify you if your data is compromised.

Recommendation

Norton LifeLock is a comprehensive service that not only monitors your credit but also provides identity theft insurance. It’s a small price to pay for peace of mind.

Personalised Financial Advice: Your AI Financial Advisor

AI isn’t just about numbers; it’s about understanding you. Apps like Cleo and Albert offer personalised financial advice based on your habits and goals.

How It Works

- Cleo: Uses AI to analyse your spending and offers personalised budgeting advice with a dash of humour.

- Rocketmoney: Rocket Money, formerly Truebill, helps manage subscriptions, track spending, and create budgets. It even negotiates lower bills, making saving money effortless.

Recommendation

Cleo is fantastic if you prefer a casual, conversational approach to financial advice. As a fun side note, apps like Cleo even have a “swear jar” feature to keep you entertained while managing your finances! hahaha hilarious!! For more in-depth guidance, Rocketmoney offers a holistic view of your finances and actionable advice.

Using ChatGPT for Personal Finance Management

AI has revolutionised many aspects of our daily lives, and personal finance management is no exception. One tool that stands out in this arena is ChatGPT. Imagine having an intelligent, non-judgmental financial advisor available 24/7, ready to assist with budgeting, expense tracking, investment advice, and more. That’s exactly what ChatGPT offers.

How ChatGPT Can Help

ChatGPT leverages advanced natural language processing to understand and respond to your financial queries. It can analyse your spending habits, suggest budgeting strategies, offer investment advice, and even provide insights into improving your credit score. The best part? It tailors its advice to your specific financial situation, making the recommendations highly relevant and actionable.

5 Ways ChatGPT Can Manage Your Personal Finances

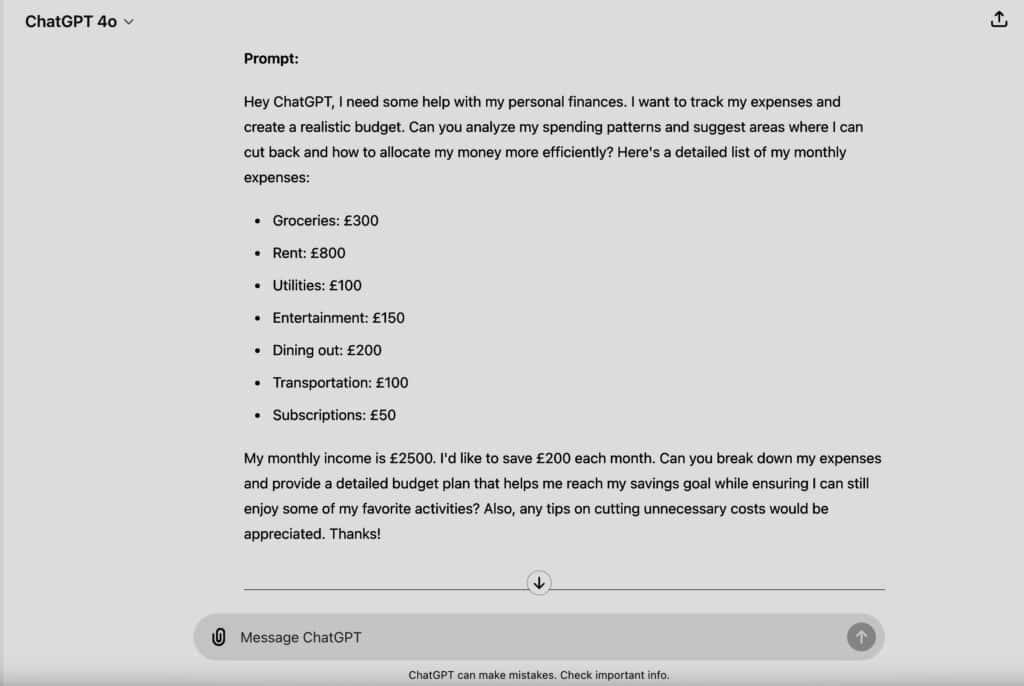

- Expense Tracking and Budgeting ChatGPT can help you track your expenses and create a realistic budget. By analysing your spending patterns, it suggests areas where you can cut back and how to allocate your money more efficiently. Example Prompt: “Analyse my monthly expenses from this list: groceries £300, rent £800, utilities £100, entertainment £150, dining out £200. Suggest a budget to save £200 a month.”

- Investment Advice ChatGPT can provide tailored investment advice based on your financial goals and risk tolerance. Whether you’re a seasoned investor or just starting, it can recommend investment strategies that align with your objectives. Example Prompt: “I have £5000 to invest. I prefer low-risk investments with steady returns. Can you suggest a diversified investment portfolio?”

- Debt Management Managing debt can be daunting, but ChatGPT simplifies this by providing strategies to pay off loans more quickly and efficiently. It can recommend the best approaches for managing credit card debt, student loans, or mortgages. Example Prompt: “I have a credit card debt of £2000 at 18% interest and a student loan of £5000 at 5% interest. Which should I pay off first, and how can I plan my payments?”

- Credit Score Improvement ChatGPT can help you understand your credit score and provide actionable tips to improve it. By analysing your financial behaviour, it suggests specific steps to boost your credit health. Example Prompt: “Here’s a summary of my credit activity: credit card usage 80%, two late payments, no loans. How can I improve my credit score in the next six months?”

- Saving for Goals Whether it’s saving for a holiday, a new car, or an emergency fund, ChatGPT can help you set and achieve your savings goals. It offers personalised savings plans and tracks your progress. Example Prompt: “I want to save £3000 for a holiday in 12 months. My monthly income is £2500, and my expenses are £2000. How much should I save each month, and do you have tips to achieve this goal?”

Personal Anecdotes and Recommendations

As someone who frequently uses ChatGPT for financial management, I’ve found it to be incredibly insightful and practical. For instance, I use a shopping round-up system to transfer spare change to savings, which ChatGPT suggested. If you want to learn further about How to use ChatGPT and How to write prompts using the RISE framework to get better results, please subscribe to our newsletter and get the FREE Guide.

I’ve also provided anonymised bank statements to ChatGPT to gain insights into my spending habits and receive recommendations on how to reduce unnecessary expenses. By integrating tips from Experian Boost and other credit monitoring tools, my credit score has significantly improved. ChatGPT has not only helped me maintain a healthy credit score but also guided me on investment strategies through Female Invest, a platform I highly recommend. I will talk further about investment and Female Invest in near future.

Family Finances: Teaching Kids/Teens About Money

Financial literacy isn’t just for adults; it’s crucial to teach kids about money management early on. AI-powered tools like GoHenry and Osper provide practical and engaging ways to introduce children to financial concepts.

A study by The Money Advice Service found that children who are taught about money from a young age are more likely to develop healthy financial habits as adults. These tools can be pivotal in fostering financial literacy.

How It Works

- GoHenry: Offers a prepaid debit card for kids with a companion app for parents. It allows parents to set spending limits, assign chores, and track savings goals.

- Osper: Similar to GoHenry, it provides a prepaid card and app with additional features like parental controls and educational resources.

Recommendation

I highly recommend GoHenry for its comprehensive features and educational tools. It’s a great way to introduce kids to money management in a controlled environment.

In on of my previous post about house cleaning management for kids, I discussed rewarding children for their household contributions. By depositing these rewards into their bank cards, kids can learn to manage their finances effectively. AI tools like GoHenry and Osper make this process seamless, allowing parents to set spending limits, assign chores, and track savings goals.

But, Is AI Overhyped in Personal Finance?

While AI tools offer many benefits, it’s important to consider potential downsides. Over-reliance on AI can lead to a lack of personal engagement in financial management. Critics argue that AI may not fully understand the nuances of individual financial situations and that there’s a risk of data privacy breaches.

A Harvard Business Review article highlights that 20% of users feel less in control of their finances when relying solely on AI tools. Additionally, data privacy remains a significant concern, as evidenced by numerous high-profile breaches in recent years.

To mitigate these concerns, it’s essential to use AI tools as supplements rather than replacements for personal financial management. Maintaining a balanced approach where you actively engage with your finances while leveraging AI for insights and automation can provide the best of both worlds.

Conclusion: Embrace the Future of Finance

In conclusion, AI-powered personal finance management tools offer a myriad of benefits, from automated budgeting and investing to credit score monitoring and fraud detection. These tools can provide personalised advice and help you make informed financial decisions with ease. However, it’s crucial to maintain a balance and stay engaged with your financial health to ensure you’re making the best choices for your unique situation.

So, why not give AI a try? You might find that managing your finances has never been easier or more fun. Share your experiences with these tools and let us know how they’ve helped you take control of your financial future. And remember, the first step to financial freedom is just a click away.

See you in the next post